Protect Your Home and Properties With Comprehensive Home Insurance Protection

Comprehending Home Insurance Coverage Protection

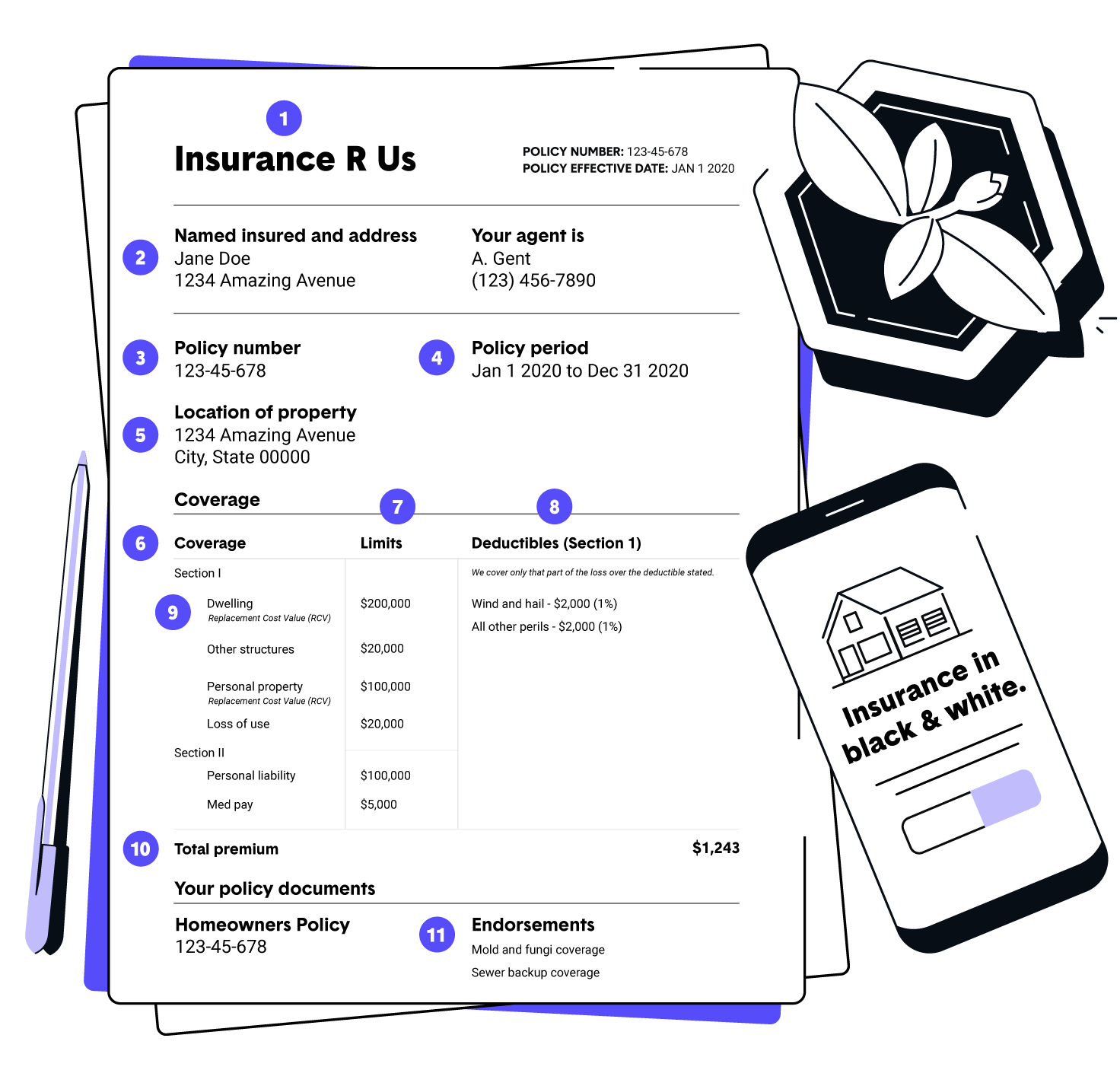

Comprehending Home Insurance coverage Coverage is important for property owners to shield their residential or commercial property and possessions in situation of unforeseen occasions. Home insurance usually covers damages to the physical structure of the house, individual belongings, liability defense, and extra living expenses in case of a covered loss - San Diego Home Insurance. It is important for house owners to understand the specifics of their plan, including what is covered and left out, policy restrictions, deductibles, and any additional endorsements or riders that may be essential based upon their individual conditions

One trick element of understanding home insurance policy protection is understanding the difference between real cash value (ACV) and substitute price coverage. Property owners should also be aware of any coverage restrictions, such as for high-value things like precious jewelry or art work, and take into consideration acquiring added protection if essential.

Benefits of Comprehensive Plans

When discovering home insurance protection, home owners can gain a deeper recognition for the protection and comfort that includes detailed policies. Comprehensive home insurance coverage supply a vast array of benefits that exceed fundamental protection. One of the crucial benefits is the substantial defense it gives for both the structure of the home and its contents. In case of natural disasters such as floods, tornados, or fires, detailed plans can aid cover the expenses of fixings or substitutes, ensuring that homeowners can recoup and reconstruct without bearing the complete financial worry.

Furthermore, comprehensive policies usually include insurance coverage for obligation, providing protection in instance someone is hurt on the residential property and holds the home owner responsible. This responsibility protection can assist cover clinical bills and lawful expenses, giving additional assurance for house owners. Detailed plans may additionally provide additional living costs protection, which can help pay for momentary housing and other required costs if the home becomes unliveable due to a protected occasion. Generally, the detailed nature of these policies offers house owners with robust protection and financial safety in different situations, making them a useful financial investment for securing one's home and possessions.

Customizing Coverage to Your Requirements

Customizing your home insurance policy coverage to align with your specific requirements and circumstances makes certain a efficient and tailored protecting method for your residential property and assets. Customizing your insurance coverage permits you to attend to the special aspects of your home and possessions, giving an extra extensive guard versus possible risks. Ultimately, personalizing your home insurance coverage offers tranquility of mind recognizing that your assets are safeguarded according to your unique circumstance.

Guarding High-Value Assets

To adequately safeguard high-value assets within your home, it is necessary to examine their worth and consider specialized coverage alternatives that deal with their distinct value and significance. High-value properties such as art, fashion jewelry, antiques, and collectibles may go beyond the insurance coverage restrictions of a conventional home insurance plan. It is important to work with your insurance policy provider to ensure these things are sufficiently shielded.

One method to protect high-value assets is by setting up a different plan or recommendation specifically for these products. This customized protection can offer greater coverage limitations and may additionally include additional securities such as insurance coverage for unintentional damage or strange loss.

Furthermore, before obtaining insurance coverage for high-value possessions, it is a good idea to have these products skillfully assessed to develop their current market value. This assessment paperwork can help simplify the insurance claims process in the occasion of a loss and make sure that you receive the ideal repayment to change or repair your navigate to these guys beneficial ownerships. By taking these proactive actions, you can delight in satisfaction recognizing that your high-value assets are well-protected against unforeseen scenarios.

Claims Refine and Plan Administration

Final Thought

To conclude, it is important to ensure your home and possessions are sufficiently protected with comprehensive home insurance policy coverage. By recognizing the insurance coverage options available, customizing your plan to satisfy your specific requirements, and securing high-value assets, you can mitigate risks and prospective monetary losses. Furthermore, recognizing with the cases procedure and properly click site handling your plan can assist you browse any kind of unanticipated events that may develop (San Diego Home Insurance). It is critical to prioritize the protection of your home and possessions with detailed insurance policy protection.

One secret aspect of understanding home insurance policy protection is recognizing the distinction between actual cash value (ACV) and replacement cost insurance coverage. House owners ought to likewise be aware of any protection restrictions, such as for high-value products like precious jewelry or art work, and think about purchasing added protection if necessary.When discovering home insurance protection, house owners can gain a much deeper admiration for the security and tranquility of browse around this web-site mind that comes with extensive plans. High-value possessions such as great art, jewelry, vintages, and collectibles might exceed the protection limits of a typical home insurance plan.In conclusion, it is essential to guarantee your home and possessions are adequately secured with comprehensive home insurance protection.